We here at Cimetrix are excited that we are implementing a new process that will both benefit our clients and the environment. We have always delivered our software runtime license orders to our clients on CDs along with hardcopies of their Certificates of Authenticity (COA). Well, starting January 1st, we will begin delivering orders to our clients through emails that will include a digital COA for each runtime license and instructions on how to download their software.

As a company, we have always prided our self on providing the finest quality customer experience possible so we feel that this new process is just one more step in improving our service. There are a number of benefits of this change:

-

Most of our clients integrate Cimetrix’s software with their own software by using the Software Development Kit (SDK), most runtime license CDs are simply thrown away, which in today’s world is really not acceptable. By making this simple change, we will be eliminating thousands of pounds of potential waste.

-

We are constantly improving our software products and the latest version should always be obtained from our Support website (cimetrix.com/online-support)—not from a CD stored on a shelf somewhere for who knows how long. This change ensures that the latest version of our software will always be used.

-

The shipping cost and time delay by sending CDs by a carrier will be eliminated which will be a direct cost savings to you.

-

The proof-of-purchase for our runtime license is the COA, not the CD. The COA number is what is used to obtain the license code using our online license generator.

So the only thing we need our clients to do is to make sure we have an email address on file of where they would like their future orders sent. It’s that simple. We do foresee a period of adjustment for some clients, so for those that still want CDs and hardcopy COAs delivered, we will have this option available for an additional fee.

Of course, if you have any questions or comments regarding this policy, we are always happy to hear from you. You can contact us at Orders@Cimetrix.com.

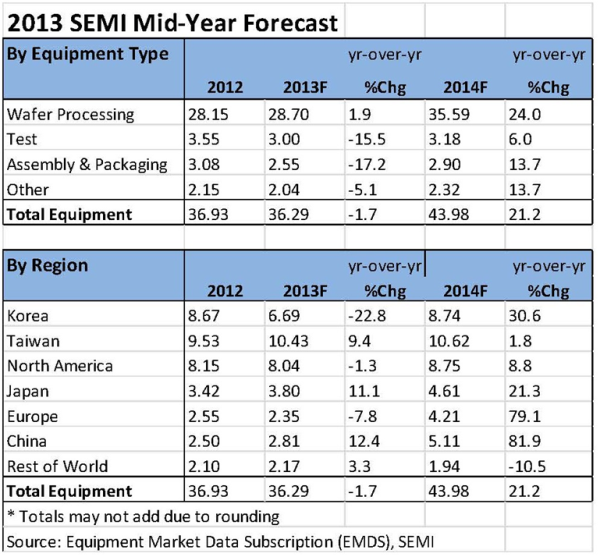

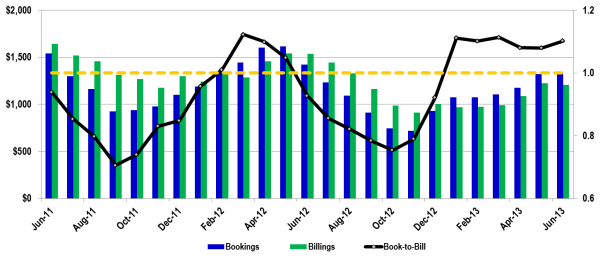

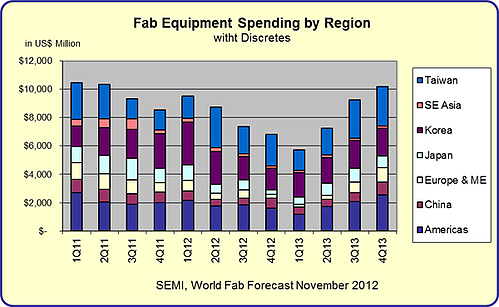

.jpg?width=311&height=394&name=financialrecovery(1).jpg) It is starting to feel like a recovery in the semiconductor industry. Wall Street is saying to keep on eye on semiconductor stocks and even semiconductor equipment stocks. SEMI just reported that worldwide semiconductor equipment bookings for Q2 2009 were 83% greater than Q1 2009. Capacity utilization is likely to reach 88% in Q3 2009 according to IC Insights, up from 57% in Q1 2009. And the SEMI World Fab Forecast is now calling for a 64% increase in fab spending in 2010. The fear is starting to subside. Q1/Q2 2009 appear to be the low point for equipment suppliers and we appear to be heading up the hill, but starting from a very low elevation. I think we are finally in the recovery.

It is starting to feel like a recovery in the semiconductor industry. Wall Street is saying to keep on eye on semiconductor stocks and even semiconductor equipment stocks. SEMI just reported that worldwide semiconductor equipment bookings for Q2 2009 were 83% greater than Q1 2009. Capacity utilization is likely to reach 88% in Q3 2009 according to IC Insights, up from 57% in Q1 2009. And the SEMI World Fab Forecast is now calling for a 64% increase in fab spending in 2010. The fear is starting to subside. Q1/Q2 2009 appear to be the low point for equipment suppliers and we appear to be heading up the hill, but starting from a very low elevation. I think we are finally in the recovery.